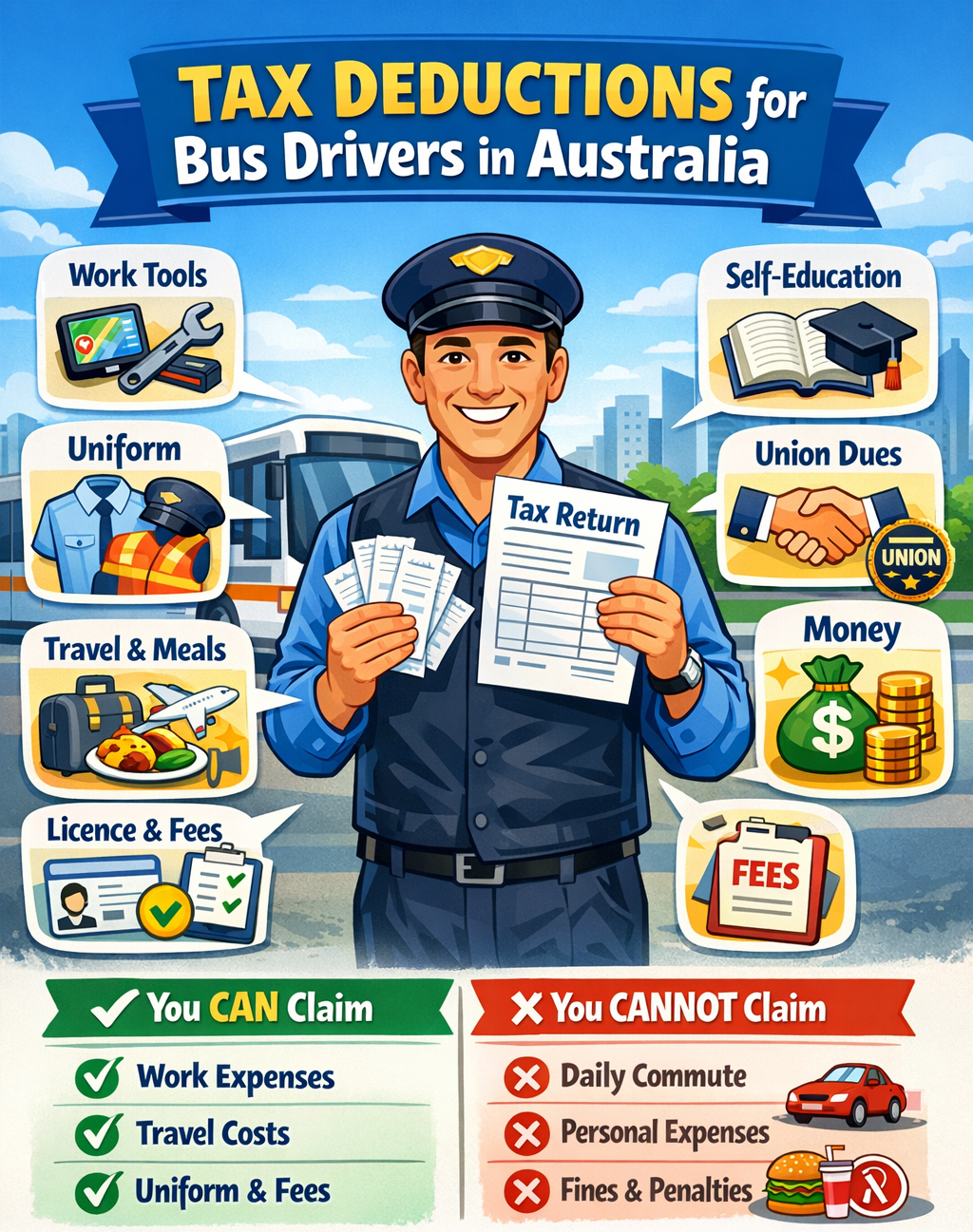

Bus Driver Tax Deductions in Australia: What You Can and Cannot Claim

Basic Rules for Claiming Work-Related Deductions

Before claiming any deduction, the ATO requires that all three conditions are met:

- You must have paid for the expense yourself

- The expense must directly relate to earning your income

- You must have records to prove it

You can only claim the work-related portion of an expense. Any private use must be excluded.

Car and Travel Expenses for Bus Drivers

What You Cannot Claim

You cannot claim:

- Normal travel between home and your regular depot

- Travel just because you work split shifts

- Travel outside normal business hours

These are considered private expenses under ATO rules.

What You Can Claim

You may claim car expenses if you drive:

- Between two separate jobs on the same day (not involving home)

- Between different depots for the same employer

- From home directly to an alternative workplace, such as a training centre

You must keep appropriate records, such as a logbook, where required.

Travel Expenses When Working Away Overnight

If your job requires you to stay away from home overnight, such as multi-day tour driving, you may be able to claim:

- Accommodation

- Meals

- Incidental travel costs

However:

- You cannot claim if your employer paid or reimbursed you

- A travel allowance alone does not guarantee a deduction

- You must show the travel was necessary to earn your income

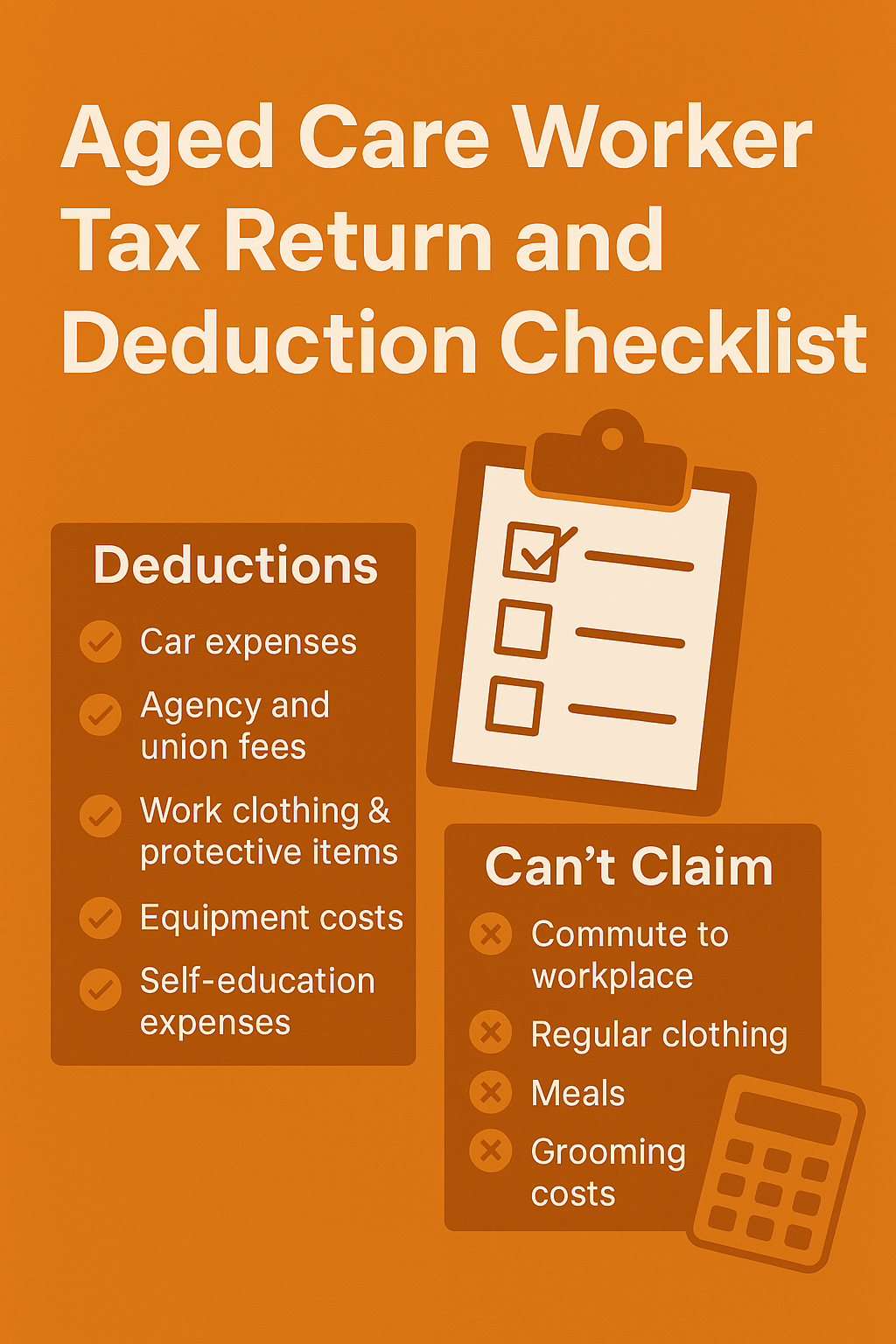

Clothing, Laundry and Footwear Claims

Most everyday clothing is not deductible, even if your employer requires it.

You May Claim:

- Protective clothing, such as steel-capped boots or hi-vis vests

- Compulsory uniforms that are distinctive and enforced by policy

- Registered non-compulsory uniforms

You cannot claim clothing costs if your employer pays or reimburses you.

Driver’s Licence and Assessments

What You Cannot Claim

- Cost of getting or renewing a standard driver’s licence

- Initial cost of special licences required to get the job

What You Can Claim

- Costs to renew special licences or permits required to perform your current role (for example, heavy vehicle endorsements)

- Compulsory medical checks or assessments, such as Working With Children Checks, if required for your current employment

Other Common Deductions for Bus Drivers

You may be able to claim the work-related portion of:

- Sunglasses and sunscreen if exposed to the sun for long periods

- Overtime meals where an overtime allowance is paid and declared

- Cleaning products for the bus if not supplied by your employer

- Diaries or logbooks used for work purposes

- Phone and internet expenses (work-related use only)

- Union and professional association fees

You cannot claim:

- Music or streaming subscriptions

- Childcare costs

- Seat covers

- Flu shots or vaccinations

- Any expense reimbursed by your employer

Record-Keeping Is Critical

The ATO expects you to keep records such as:

- Receipts

- Logbooks

- Diaries

- Digital records using the ATO myDeductions app

Why Work With a Registered Tax Agent?

Bus drivers often miss deductions or accidentally overclaim due to a misunderstanding of ATO rules. Working with a registered tax agent helps ensure:

- You only claim what you are entitled to

- Claims are backed by correct records

- Your return complies with current ATO guidance

At Bookbrite Accounting and Taxation Advisers, we assist bus drivers across Australia with compliant tax returns, record-keeping advice, and audit support.

ATO Reference

This article is based on ATO occupation guide QC61150 – Bus drivers' income and work-related deductions, and the ATO Bus Driver Tax Time Toolkit